This is consistent with an abrupt slowdown in house price inflation last seen in 2008. Annual rise could exceed 1000.

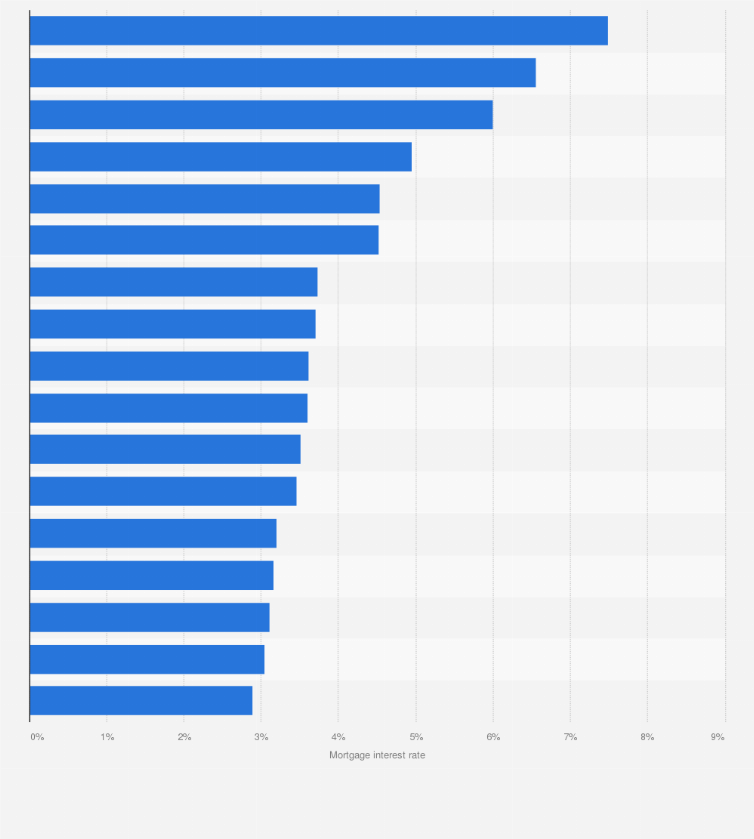

Mortgage Interest Rate Uk 2010 2021 Statista

The average for the month 782.

Mortgage interest rates uk prediction. This could mean an end to record low mortgage rates so its worth checking now if. MORTGAGE costs will rise for hundreds of thousands of homeowners after the Bank of England put up interest rates to a 13 year high. The table below reveals how much incremental increases to a tracker mortgage rate can add to an average borrowers monthly mortgage repayments.

At least nine banks and building. The market is predicting that the Bank of England base rate will be over 2 by February 2023 and over 25 by the end of 2023. Over a year this would add up to 672.

Analysis by investment platform AJ Bell shows the impact on borrowers mortgage costs. June 16 2022 558 pm Updated 620 pm Millions of homeowners are set to see their mortgages rise by hundreds of pounds a year after the Bank of England BoE hike in interest rates today. Maximum interest rate 815 minimum 767.

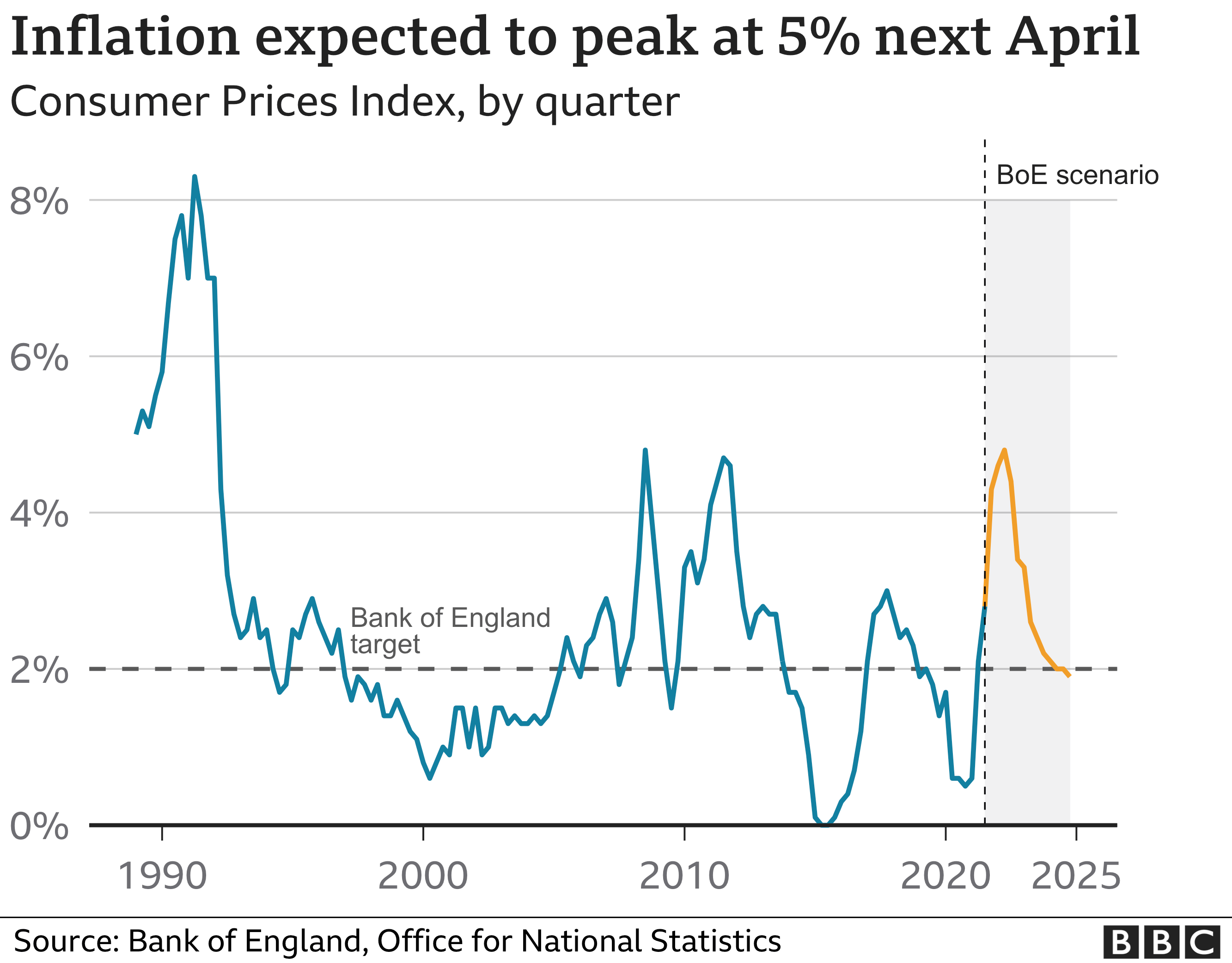

The Bank of England BoE today increased the base rate by 025 percentage points taki. The economic research consultancy expects the average rate on new mortgages to rise from 18 per cent in Q1 to 33 per cent by end of 2022 then to peak at 36 per cent in 2023 as lenders rebuild their margins. This is the highest level to which inflation risen in 40 years and provides official confirmation of what consumers have been noticing in their day-to-day finances that the cost of living is soaring.

The average for the month 789. By quarter two of 2023 the OBR predicts mortgage cost rises will peak at 148 per cent before beginning to fall to 10 per cent in Q4. MORTGAGE MARKET FORECASTS UK Finance produces independent forecasts for the mortgage and housing markets over a two year time horizon.

UK Finance predicts mortgage lending will drop by 35bn in 2022 in what it describes as a return to more stable levels of activity Fewer people buying homes should result in a calmer mortgage market with more activity likely to come from existing homeowners remortgaging and less from people buying homes. Firstly in December when the rate was changed from 015 to 025. The average interest rate for a two year fixed term mortgage deal has increased from 234 at the beginning of December to 325 according to Moneyfacts a price.

Maximum interest rate 806 minimum 760. As a guide if the Bank of England puts interest rates up by 05 that would add 56 a month to a 25-year 200000 mortgage for those on a tracker mortgage deal. The chances of the Bank of England increasing interest rates again have risen after it was announced today inflation had climbed to 9.

Based in Central London We Specialise in Mortgages for British Expats in Italy. Britainss inflation rate is currently running at a 40-year high of 9. Based in Central London We Specialise in Mortgages for British Expats in Italy.

MORTGAGE bills are set rise by hundreds of pounds for millions of homeowners after another interest rate hike. Mortgage Interest Rate forecast for September 2023. On Thursday the Bank of England confirmed the base interest rate in the UK would increase to 125 - a 13-year high - in an attempt to limit the rise of soaring interest rates.

British lenders have started to ramp up the pace of price increases on their fixed-rate mortgages as they brace for higher interest rates from the Bank of England. The increased interest rates from 1 to 125 could cost homeowners an additional 354 to their annual mortgage payments warns online mortgage broker Trussle. Mortgage bills are set to rise for millions of UK homeowners after the Bank of England BoE hiked interest rates for the fifth consecutive month to tackle inflation.

Downloads Economic and Market Context 01112021 PDF. HSBC Barclays First Direct and Virgin Money hit homeowners with rates rise within HOURS of Bank of England increasing interest rates. Each time the rate has been increased the Bank has cited soaring inflation as the.

The Office for Budget Responsibility OBR - the governments official independent forecaster -. Again in February 2022 when it was increased to 05 and again in March when it was increased to 075. Since the end of 2021 the UK has seen four increases to the Bank of Englands Base Rate.

A leading debt charity has warned of a potential cliff edge for Britons making mortgage repayments amid rising interest rates. The central bank hiked the base rate by 025 percentage pointsnb. The 30 Year Mortgage Rate forecast at the end of the month 783.

Experts are forecasting that the 30-year fixed-mortgage rate. June 17 2022 159 pm Updated 258 pm Millions of homeowners are to be hit with higher bills after several lenders increased their mortgage. Below I explain what you should be doing now before going on to explain what will ultimately determine when interest rates will go up.

An average rise of five per cent in mortgage costs is anticipated for the year. Ad Get a Mortgage for Your UK Home or Buy to Let Property. Tesco sales drop.

Official forecasters say the biggest mortgage rate rises will be in 2023. In much the same way movements to UK interest rates can sometimes be forecast. Ad Get a Mortgage for Your UK Home or Buy to Let Property.

30 Year Mortgage Rate forecast for October 2023. Mortgage rates could dramatically rise after new forecasts from the Office for Budget Responsibility OBR show the Bank of Englands base rate could rise to 35. Includes gross and net lending for residential and buy-to-let markets refinancing total property transactions and mortgage arrears and possessions.

We provide the latest interest rate forecasts and predictions from leading UK experts together with comment on what it all means and how factors like inflation and energy prices are influencing interest rate forecasts. As inflation increases the Fed reacts by applying more aggressive monetary policy which invariably leads to higher mortgage rates. It was the fifth rise since December 2021 when Bank rate stood at just 01 and will add around 312 a year onto the cost of a 200000.

The central bank lifted the key rate by 25 basis points to 125 the highest in 13 years and a level not seen since the financial crisis. Millions face mortgage misery.

Mortgage Interest Rate Portugal 2013 2021 Statista

Bank Of England Hints At Future Interest Rate Rise Bbc News

Comments